Suppose you’re a growth marketer in a Chinese or Asia-based B2B company. In that case, you’ve probably felt that tension: you must expand to the U.S.—but you also fear burning money on weak leads, cultural mismatches, and poor localization. This article is your field guide: a story-driven, tactical roadmap to entering the U.S. B2B space with lean capital and smart bets.

Why the U.S. is tempting — and dangerous

The U.S. market holds scale, some of the world’s deepest pockets, and brand prestige. But many Chinese B2B companies entering the U.S. end up repeating mistakes: competing on price, assuming domestic channels transfer, or underinvesting in localization. Some insights from adjacent cases:

- Chinese consumer plays like Temu, Shein, and TikTok didn’t win purely by being cheaper—they reengineered demand funnels and built culturally native marketing loops.

- Alibaba is trying to crack U.S. wholesale by targeting SMBs—showing that U.S. demand exists even for Chinese supply if positioning and go-to-market are right. (Rest of World)

- China’s own leadership is cautioning firms to avoid internal “involution”(內卷, nèijuǎn) (i.e. destructive price wars) when going global. (Business Insider)

- When Chinese companies export, their biggest disadvantage often is trust, compliance, brand awareness, and U.S. buyer behavior—not manufacturing cost.

To beat these traps, you need a discipline-first, proof-first framework.

The LT (Lean Testing) U.S. GTM (Go To Market) Framework

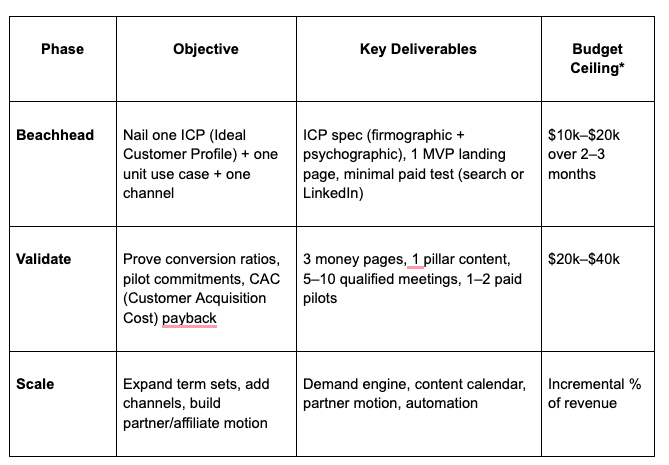

Here’s a three-phase path (Beachhead → Validate → Scale) with guardrails to protect your budget.

* These are illustrative ranges; actual numbers depend on your vertical, product complexity, and margins.

Why this works

- You don’t spend across 10 channels at once. You pick one channel (say, Google search) and one ICP (say, “industrial OEMs in the Midwest”) to probe first.

- You publish pilot project’s ROI + SLA (Service Level Agreement) ranges from day one. Buyers appreciate clarity.

- You kill underperforming keywords or creative every week. No sacred cows.

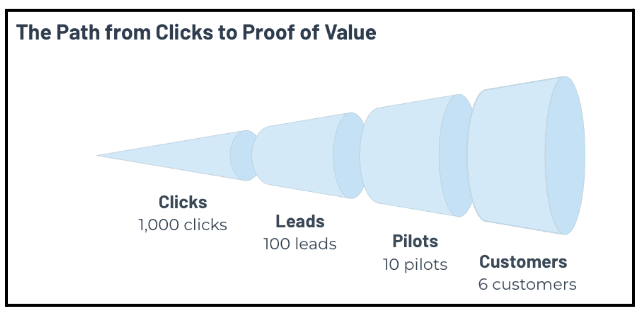

You only pour more budget when you see a repeatable “Only scale once, payback is under a year, and pilots convert consistently.”

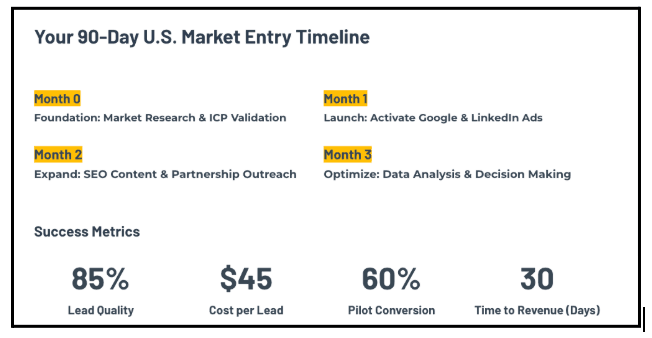

Step-by-Step: What you do in each month

Month 0: Strategy & Planning

- Pick one beachhead vertical + one sub-use case (e.g., “food packaging suppliers needing order management automation”).

- Interview 3–5 U.S. buyers (via LinkedIn / your contacts) to test framing, objections, and price sensitivity.

- Draft Ideal Customer Profile (title, size, existing tech, incentives, objections).

- Plan landing pages you’ll launch (e.g. “Order exceptions automation for packaging OEMs”, “U.S.-grade SLAs with China-built platform”).

- Set up minimal analytics and attribution (UTMs, Google Analytics, call tracking).

Month 1: Launch & Test

- Launch search ads (Google) targeting narrow, exact-match terms around your Ideal Customer Profile use case.

- Push one LinkedIn campaign (single-variant) to test copy, creative, and lead magnet (e.g. ROI one-pager).

- Go live with your first landing pages + pilot pricing page.

- Book calls, qualify leads aggressively, and move 2–3 prospects into pilot discussions.

- Every week: prune 20% worst keywords/ads.

Month 2: Expand & Optimize

- Review key metrics: qualified meeting cost, pilot → paid conversion, Customer Acquisition Cost payback, sales cycle length.

- If all signals align, allocate more budget and test secondary channels (e.g. display, niche conferences, targeted trade publications).

- Build out associate content (whitepapers, webinars) to feed mid-funnel leads.

- Document your processes and refine your dashboard.

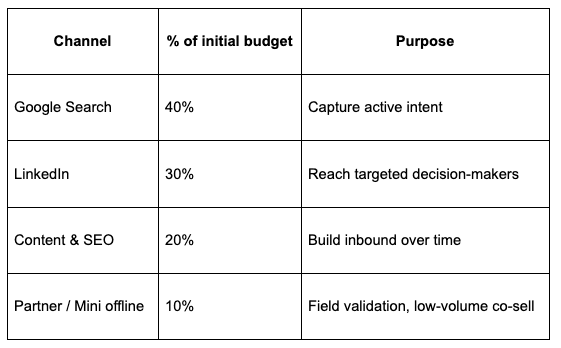

Channel Guide & Budget Benchmarks

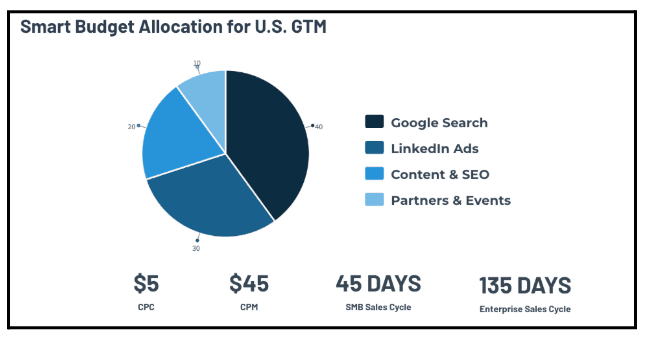

Most Chinese B2B marketers incorrectly assume U.S. Customer Acquisition Cost are low. They aren’t.

- In B2B verticals, search Cost per Clicks often run $3–$5+ on targeted terms (e.g., “order management automation for OEMs”).

- LinkedIn Ads: expect ~$5–7 Cost per Click, depending on seniority targeting.

- You must balance volume vs quality—best leads often cost 2-3× more.

Budget allocation in lean test stage:

Over time, shift more into content, SEO,GEO and partner referral channels, which compound

SEO & Content Strategy: Rank and Convert

Here’s how to build an SEO engine that drives real U.S. leads, not just clicks.

1. Pillar + Cluster Design

Create one cornerstone article—like “How U.S. Manufacturers Automate Orders Without Replacing Their ERP.” Keep it 2,500–4,000 words covering your GTM framework, ROI math, and U.S. buyer pain points.

Support it with cluster posts (e.g., EDI vs API for OEMs, SLA Basics for U.S. Clients) to build depth and authority.

2. Landing Pages

Target transactional intent with U.S.-localized offers:

“U.S. Pilot Program for Supply Chain Teams” or “Pricing & Agreement for American Clients.”

Show pilot math, ROI examples, and clear CTAs like “Book a 30-min call.”

3. Internal Linking

Guide readers from pillar → cluster → money page → demo for a natural conversion flow.

4. Trust & Compliance Content

Add pages for Data Security, Agreement Policy, and U.S. Terms. They prove reliability and ease buyer concerns before contact.

5. Keyword Clusters to Own

Focus on phrases U.S. buyers search for:

B2B SaaS pilot pricing · supply chain automation US

6. FAQ / Schema / Voice Queries

Address real objections—“Where is your data hosted?”, “Do you offer U.S. timezone support?”—and use FAQ schema for featured snippets.

Over time, this structure can drive 30–50% of qualified pipeline organically, reducing paid spend and building lasting credibility.

Common Objections & Narrative Positions

To compete well, your messaging must preempt U.S. buyer doubts:

- “Is a Chinese-built solution reliable?” — Answer with Service Level Agreement metrics, redundancy, case references, U.S. support.

- “What about compliance, data & liability?” — Have a dedicated compliance/security page (e.g. SOC2, encryption, U.S. DMZ).

- “Why not a domestic vendor?” — Lay out Total Cost of Ownership math prebuilt vs build vs your solution, plus service differentiators.

- “Can you serve in U.S. time zones and handle integration support?” — Emphasize local support, perhaps a small U.S. team or partner.

- “How do I trust you?” — Publish U.S. proof, named or anonymized case studies, partnerships, press.

Your narrative isn’t “cheap China system.” It’s “global engineering, U.S.-grade reliability, pricing leverage.”

Case Example

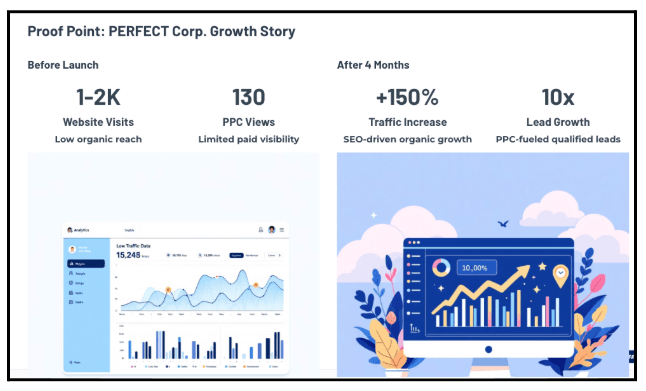

Let’s look at PERFECT Corp., a NASDAQ-listed SaaS provider specializing in AI and AR for the beauty and fashion industry.

When they wanted to grow their China market presence, the challenge was unique: the global website was managed centrally in Taiwan, making localized Baidu SEO and PPC optimization difficult.

Instead of spreading spend across multiple channels, PERFECT adopted a disciplined, lean testing strategy—focusing only on Baidu search first.

They began with deep keyword research and precise PPC targeting to match local buyer intent. Every week, underperforming keywords and creatives were pruned, while top performers were refined and reallocated. Conversion tracking was integrated early: forms, hotlines, and analytics dashboards, to ensure every click could be traced to a real lead.

Meanwhile, SEO work ran in parallel: audit → plan → track → optimize. Each week’s progress was reported transparently, and strategies were adjusted based on data trends.

Within four months, organic and paid traffic surged by 150%, and weekly leads grew 10×.

This data-driven iteration loop, focus, measure, optimize, repeat—shows exactly how a B2B SaaS brand can expand into a new market without burning budget. The same framework applies for Chinese B2B firms entering the U.S.: start narrow, instrument early, and scale what works.

Risks, Guidelines & Cultural Pitfalls

- Don’t overextend to multiple verticals too early. Many Chinese firms try 5 verticals at once; they never prove one.

- Beware aggressive “Made in USA” or “U.S. brand” claims. The Federal Trade Commission enforces truth in advertising. Unless your product qualifies, avoid misleading claims.

- Localization is more than translation. Tone, idioms, use cases, and objections differ in U.S. B2B culture.

- Cultural navigation in U.S. procurement cycles. U.S. buyers expect documented SLAs, audits, third-party reviews, and often need compliance certifications.

- Political & trade risk. Stay updated on export laws, trade barriers, and U.S.-China policy shifts.

Final Thoughts: Play to proof, not hype

Too often, Chinese B2B entrants rush to scale before they validate. They measure “awareness,” build a broad site, or hire dozens of agencies—and then wonder why leads don’t convert.

The lean path is slower in month 1 but safer. Nail one ICP, serve proof, win pilots, then scale. That’s how you get a capital-efficient launch, not a vanity budget burn.

Your mission: build a U.S. B2B engine that someday can deliver 50%+ of pipeline via low-cost inbound. But your first step is disciplined testing, clarity in offers, and ruthless pruning. Do that, and you’ll outrank, outlast, and outgrow many who came before you.

Ready to explore the U.S. B2B market but not sure where to start?

If you’re a growth marketer or founder at a Chinese or Asia-based B2B company and want to avoid the common pitfalls, we’re here to help.

Reach out to us directly. We’re happy to share insights, templates, and real examples from similar companies.

👉 Contact us (Reply within 1 business day)