If you’re also using Google Ads for B2B exports but struggling with the three major hurdles — “high CPC, low inquiries, low conversion rate” — then this real case is worth saving + sharing.

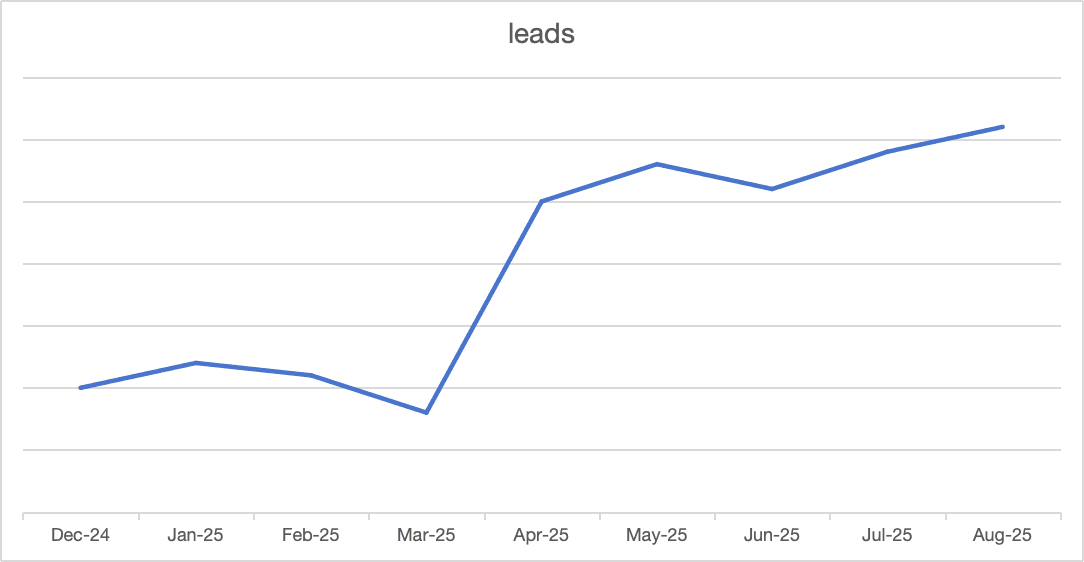

We scaled eSurvey’s weekly leads from 2–3 to 7–8, while keeping costs flat and tripling ROI. The methods are fully open — just copy and apply.

01 Turn “US + Vietnam” into a world map — expand regions first, then split budgets

Pain point:

After launch tests, focusing only on the US and Vietnam led to ridiculously high CPC and very few inquiries. The Google algorithm wasn’t fed enough data, and the learning phase dragged on indefinitely.Action:

Expanded targeting to 18 T3–T4 markets: Europe (Germany/France/Italy/Spain), South America (Brazil/Chile/Argentina), Japan, India, Indonesia, Turkey, etc.

Used two dimensions — actual GNSS equipment import value + local infrastructure investment — to rate each country 1–5 stars, then allocated budgets by star rating:

●5 stars (Germany, Japan, India) → 35%

●4 stars (France, Brazil, Turkey) → 25%

●Remaining 3-star countries → 40% (low-cost volume grab)

Applied Campaign-level location bid adjustments: +25% for 5-star, –20% for 3-star, letting budget automatically tilt toward high-potential markets.

Result:

Impressions ↑186%, clicks ↑142%, while CPC ↓19%, because the algorithm finally got “enough food” and found more relevant audiences.

02 Weekly “negative keyword cleanup” — reclaim wasted spend

Pain point:

Search term reports always showed traffic like “survey questionnaire” or “free GPS app,” eating up 20%+ of the budget.Action:

● Set a fixed weekly analysis routine:Export last 7 days’ Search Terms Report;

●Terms with CTR >1% but no conversions → exact negative;

●Terms containing “free / cheap / download / pdf / job” → phrase negative;

●Non-intent-matching terms → direct negative.

Built a “Master Negatives” shared list, synced across all Search/Shopping/Performance Max campaigns, avoiding repeated waste.

Result:

Continuous negative keyword optimization made subsequent searches far more intent-driven.

03 Multilingual ads are not “translation,” but localized creative 2.0

Pain point:

Even the best English ad copy loses half its CTR in Indonesia or Brazil — language barriers = traffic ceiling.Action:

Decided languages based on market priority × keyword volume: launched 5 major versions — Japanese, Portuguese, Spanish, Turkish, Hindi.

Translation workflow:

●Native industry translators handle translation;

●Local GNSS equipment distributors proofread, replacing “RTK” and “Base Station” with native jargon;

●DMS marketing team polishes copy, applying pain point + benefit + CTA formula.

Every ad used the full limits — “30-character headline + 90-character description” — with dynamic keyword insertion {KeyWord:GNSS Receiver} to boost relevance.

Result:

CTR rose significantly in non-English markets, as overseas audiences strongly preferred native-language ads.

eSurvey’s success wasn’t about “spending more,” but about “making every dollar reach the people most ready to buy.”